7月初,新加坡金融管理局MAS宣布,将在未来新颁发5张互联网银行(digital bank)的牌照,而目前国内也已有多家互联网银行发展十分迅速。一时间,互联网银行成为我身边朋友圈的热议话题。我的很多朋友就此询问我的观点,比如“你认为这些牌照最终会花落谁家?”、“我们应该申请吗?”等等,甚至有朋友告诉我,他们已经在拉拢合伙人筹措资金,来满足成立互联网银行最低的资金门槛要求,也就是1500万新币(相当于7500万人民币)。那么,到底互联网银行是怎么一回事呢?

图片来源:<a href=”http://www.freepik.com”>Designed by Blossomstar / Freepik</a>

01

—

互联网银行在新加坡能成气候么?我看难

如今,几乎所有的传统银行都有专门的网银App,相互之间转账基本都是免费的。在使用信用卡的时候,往往还能获得积分、返现等各种优惠手段。现在大家出门,只要带上手机就像带上了全世界(当然,必须带的还有你的充电器)。可以说,当前的银行体系已经可以满足我们日常的所有需求了。

如果是在一个转账收费、数字化不是那么方便的国家或地区,那么互联网银行应该还是挺有必要的。但在新加坡?我确实没有看到它们多大存在的意义。

02

—

互联网银行赚钱优势何在?

大多数普通消费者来说,往往需要银行两件最基本的东西:1、账户;2、信用卡。这两样最基本的东西的制作和生成都是银行的成本,而在消费者端都不需要花任何钱。无论你存多少钱,即使是几分,银行也会照做不误,因为这是银行业务的基石。

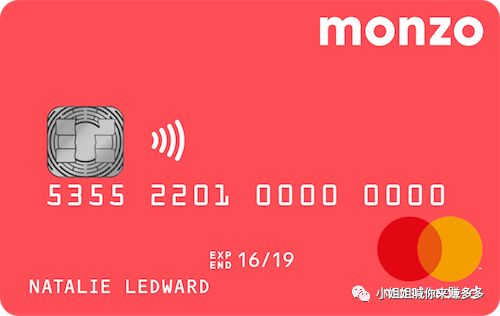

很多新的小银行在制作这些的时候也是得心应手,甚至比许多老银行都更具有创造力和吸引力,因为它们更懂得用炫酷个性的设计来吸引年轻人的眼球。例如之前我在英国的一个朋友小A就告诉我,他仅仅因为Monzo银行出的信用卡是橘粉色,萌得不要不要,就脑热申请了,而这个Monzo银行其实是一个名不见经传的小银行。

小A说,每次当他掏出这张萌萌卡的时候,都能闪瞎周围一众人的双眼,引来无数艳羡的目光,大家纷纷夸奖这卡真好(zhuāng)看(bī)。果然,人们往往只在意好看的皮囊,却往往忽视了有趣的灵魂。这叫什么来着,爱,有时就是这么简(fū)单(qiǎn)……

咳咳,扯远了,继续回来……开设帐户和发放信用卡并不难、也不是银行赚钱的渠道,那么,什么才是银行赚钱的渠道呢?答案是——贷款。银行以较低的利息吸收进大量存款,再以较高的利息放贷,从而稳赚其中的利差。此外,银行还会通过销售投资产品,如基金、债权、机构性产品等理财工具增加收入。但无论其赚钱手段多么丰富,其看家本事主要还是放贷。

说到这里,大家应该就有自己的观点了。一家初创互联网银行在这方面又有什么优势呢?难到是自己的技术优势,还是设计优势?我对此都持保留态度。因为贷款往往需要对特定部门和商业周期有深入了解,还需要强大可靠的风险管理系统,所有的这些传统银行都是经营了很多年才打下的良好基础,而一个初创企业想要在短时间内做好这些,可能性真的很高么?

03

—

但……你刚刚不是说,爱有时很简单么?

彭博社此前发表了一篇关于Monzo的文章(链接:https://www.bloomberg.com/opinion/articles/2019-06-26/monzo-can-a-2-5-billion-banking-upstart-dislodge-jpmorgan),讲到了这家银行如何试图改造传统银行业务,其中包括举办一系列“Investival众筹活动”等,在这些活动上大家可以畅饮瓶酒、痛快“撸串”,并且还可以像海草一样飘摇……

所有的这些,听起来都不像银行在办的事儿,并且听起来貌似不怎么能盈利。更重要的是,在银行本应赚钱的领域:

1、Monzo最近的报告显示,贷款仅占其总资产的0.1%左右。

2、它已经开始涉足个人贷业务,但其大部分收入都来自佣金。

3、它的主要“贷款”产品其实是信用贷透支,每月收费最高15.5英镑(其实也不是很多)。

所以,对我而言,Monzo银行并没有把重点放在银行真正的核心业务上,而是把钱都花在了啤酒和撸串上……那么,这样的“爱”又能持续多久呢?

04

—

新加坡没得搞,那么在中国呢?

我认为,在中国,互联网银行还是有很大发展空间的。其中,最成功的例子之一当属微信。众所周知,即使是街边门口卖菜大爷大妈,现在出门都不爱带钱了,每次收钱时,只要听到手机传来哔的一声,就知道钱已经到账了。微信大家使用的虽然都是钱包功能,却它是国人事实上的银行。微信支付还可以从大家的存款中赚取利润,并且拥有所有消费者丰富的财务数据。

我认为,像印度尼西亚这样的其他新兴市场,电子钱包(如Go-Pay,OVO等)也在积极发挥作用,迅速渗透入大家的生活。这些电子钱包可以自然而然地加入更多互联网银行的功能,如贷款和投资产品。因此,在这些国家或地区提互联网银行或许更有意义。但对于过度银行化的新加坡而言呢?我仍然持怀疑态度。

如果喜欢我的文章,转发个再走呗~顺手再点个“在看”嘛!比心❤️

以下为我的文章英文原文:

On all these new digital banks

So the big news over the weekend was that Singapore would be issuing up to 5 new digital banking licenses. I received a flurry of texts which ranged from “Should we apply?” to “But who do you think is going to get it?” and trying to introduce different people so they could potentially meet the minimum capital requirements of S$15million (yes it takes serious money to be a bank!), but first, here are some quick thoughts.

1) I’m not sure what the proposition of these digital banks is going to be, particularly for Singapore

All my boring brick-and-mortar banks have an i-banking application. Bank transfers are free. I get one cheque book free. I also get cashback, miles and other goodies when I use my credit card. I can pay anyone via their mobile number using PayNow. Basically, I don’t have any complaints about my current banks.

Perhaps if you live in a country where bank transfers are charged and moving money is extremely inconvenient, I can somewhat understand the proposition of a digital bank. But here? My bank is already digital.

2) I’m not sure if these digital banks are actually suited for being a bank (in the old-fashioned banking sense)

So for the average consumer, I would say there are 2 basic things they want from their bank. 1) A checking account

2) A credit card

Note: Both of these don’t cost you the consumer anything, but are costs to the bank (especially if you have a small balance). But they have to do this because this is the bedrock of being a bank.

Startups can fulfil both easily with a banking license. In fact, they can probably design better, swankier-looking credit cards that appeal to millennials. Case in point – monzo. I first heard about monzo from my friend in the UK. He signed up because the card was orangey-pink. And when paying people would always ask, “Oh what’s that card??”. So yes, people do sign up for stuff because the card is an eye-catching orangey-pink.

Giving you an account and a credit card isn’t that hard. But that’s not how banks make money.

Generally, banks make money by taking in deposits and lending out at higher rates (corporate loans, mortgages, auto loans etc).

There are other revenue generators such as selling insurance and wealth management (through the sales of investment products like funds, bonds, structured products) but the bread and butter of being a bank is really lending.

In order to lend, a bank has to be able to evaluate credit worthiness of borrowers and manage the risk of their loan book. These are practices that have been honed and perfected over decades of making loans and banks have large, specialised teams of people just focused on credit and risk management.

Can a startup do this?

I have my reservations. Growing a loan business is far beyond a technological or design problem. Lending requires deep understanding of specific sectors and business cycles, long-standing relationships and specialized risk management systems. All of which banks are well-equipped to do over the years but startups, poorly so.

3) But but but..millennials!

Bloomberg ran a great article on Monzo and how they were trying to revamp banking. This includes “Investival crowdfunding events where you can swig beer and eat street food” and “swag like T-shirts”.

Which first, doesn’t sound like a bank, and second, doesn’t sound lucrative

And most importantly, in the areas where they are supposed to be earning money

-Monzo’s most recent accounts show loans making up only about 0.1% of its total assets.

-It has started to dabble in personal lending, but the bulk of its revenue comes from fees and commissions.

-Its main loan product is overdrafts, for which it charges up to 15.50 pounds a month (which really isn’t a lot)

To me, it doesn’t bode well that they are not focusing on the core of what makes a bank a bank but instead on beer and street food.

4) But there are other countries where I think digital banks could succeed

The largest success story of course, is WeChat in China. Not everyone in China had access to banking, but most had smartphones, and WeChat Pay, though a wallet, is the de-facto bank for the Chinese population. WeChat Pay makes money from payments, used to make money from the float (when they were able to invest customers’ monies) and is a rich trove of financial data on all consumers.

I see the same playing out for other emerging markets like Indonesia where e-wallets (Go-Pay, OVO) have penetrated further than banks have. It is a natural transition for these e-wallets to be equipped with more banking functions like loans and investment products. The proposition of a digital-only bank would make much sense here.

But for overbanked Singapore? I remain skeptical.